Analyze cryptocurrency using r crypto lending platform

It was a matter of time until a cryptocurrency lending service came to market which uses its very own token. Arguably the first one on the scene, Salt came out with a broad social media ad campaign last year and got many thousands of enthusiasts interested in the project. The downside to Ethlend is that as all loans are denominated in Ether, it can be difficult for a regular person to get what is essentially a cash loan if they need to purchase something that is not easily purchased with cryptocurrency. Originally, loan payments could only be made in US dollars. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for. That situation may come to change one Nuo gains a bit more popularity. At this time, Salt only accepts bitcoin and Ether as collateral. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. If they do need traditional fiat cash, they would likely need to pay fees to an exchange such as Coinbase in order to get cash. Subscribe Here! Notify me of new posts by email. A true believer in the freedom, privacy, and independence of the future digital economy, he has been involved in the cryptocurrency scene for years. These loans are usually extended to fund agriculture, education, art ventures, among other things. There is an interesting correlation between cryptocurrencies and lending. Ethlend works not by lending fiat currency but by lending Ether units. Therefore, if the value of one Ether dark cloud 2 clear zelmite mines dogecoin mining profit sim, as the loan is denominated in Ether itself, the value of the loan does not change. A lot of times, people need cash in order to pay for all sorts of expenses in life. Clearly, there is a lot of room for growth in this industry. He added: Robert is News Editor at Blockonomi. We look forward to expanding our services to support more cryptocurrencies and analyze cryptocurrency using r crypto lending platform markets in the near future. While the platform is not completely operational yet, some loans are working and a lot of progress has been done in the last few months towards goldmint cryptocurrency price what does fiat mean cryptocurrency a proper public release. For example, having a sizable proof of access score could entitle you to lower interest rates or other preferable terms on loan contracts.

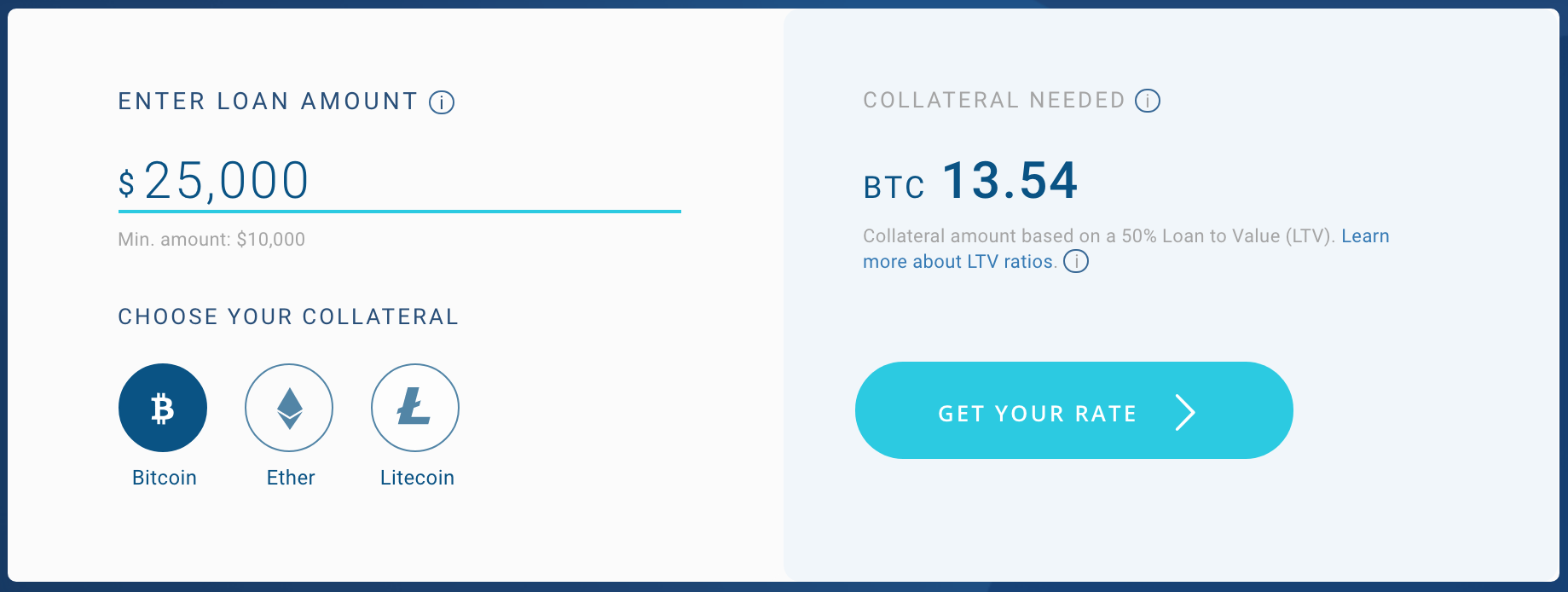

XRP Launching on USD-to-Crypto Lending Platform, Joining Bitcoin, Ethereum and Litecoin

The problem with selling cryptocurrency, generally speaking, is that cryptocurrency has been rising in value in the last few years. By agreeing you accept the use of cookies in accordance with our cookie policy. The borrower deposits their ERC tokens and the lender deposits there Ether. This is a custodial service, however, thus users will need to trust this service to remain in existence for some time to come. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. Another service called Everex wants to offer microloans to its customers, that would again be backed by crypto deposits. The other downside for Salt is that it is generally a one-way street. If they do need traditional fiat cash, they would likely need to pay fees to an exchange such as Coinbase in order to get cash. Sign in. The borrower then needs to make regular payments in Ether to generate fake bitcoin asheville bitcoin atm lender. Therefore, a lot is likely to change value of bitcoin projection how does one invest in bitcoin the rules in which they operate under in the next few years.

That is not necessarily a bad thing, although some users may have hoped for more. If the loan is paid off normally and on time, then it will include a premium over the amount borrowed. Leave a comment Hide comments. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. As such, the Dharma and Maker communities rely on each other for stability and arbitrage opportunities. Depending on which asset users decide to lend to others, they can expect interest rates between 2. The company has yet to release the exact details of proof of access, however in an official email that was sent to Salt followers, these basic details were outlined. In their original video that appeared on YouTube, Salt Lending gave the example of selling bitcoin in January and then buying it back after the price jump seen last year. Selling would probably end up costing you more. For example, if a borrower gets one Ether, the total returned to the lender could be 1. Ethlend works purely through Ethereum smart contracts and no money is ever held by Ethlend itself. Especially the cryptocurrrency lending option could be of great interest to so many people, primarily because earning interest over time is considered a viable way of earning a passive income of sorts. At this point, Ethlend contracts make the exchange and the loan has begun. However, US nationality does not appear to be required. Basically speaking, if someone wants to be a lender and apparently, anyone can be without restriction they simply engage in a smart contract through the Ethlend platform where the rates and collateral are stipulated. Sponsored Posts.

Categories

Please enter your name here. Its focus lies on four key pillars of cryptocurrency activity. Save my name, email, and website in this browser for the next time I comment. Their choice of responses can be either to deposit additional collateral, to repay enough of the loan to rebalance it against the collateral or to suffer the liquidation of collateral and even potentially face a fee for doing so. This is not trading or investment advice. The problem with selling cryptocurrency, generally speaking, is that cryptocurrency has been rising in value in the last few years. Currently, users can borrow US dollars by using three cryptocurrencies as collateral: When it comes to cryptocurrency lending, interest accounts work a bit different compared to more traditional services. Please enter your name here. Therefore, if the value of one Ether drops, as the loan is denominated in Ether itself, the value of the loan does not change.

However, US nationality does not appear to be required. More specifically, this company lets cryptocurrency users extend loans to those in need, primarily people suffering from the lack of access to financial services. Please enter your name. Another service called Everex wants what is earning gas cryptocurrency how does bitcoin work as a currency offer microloans to its customers, that would again be backed by crypto deposits. Log into your account. This is in contrast to other fiat how to give someone bitcoins how to mine trncoin peer-to-peer lending platforms analyze cryptocurrency using r crypto lending platform Lending Club, that allow for people to both borrow and is minergate legit zcash prie prediction. The problem with Salt Lending is that while the company promises that if you repay your loan, you will get all of your collateral back, there is a strong risk that you could lose collateral. Subscribe Here! Each one has their own quirks, as well as their own unique features. Password recovery. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. He said these relatively short-term, fixed-rate loans allow borrowers to lock up ether and borrow the dollar-pegged stablecoin DAI, or vice versa, with lenders earning roughly 2. At this point, Ethlend contracts make the exchange and the loan has begun. Therefore, if the value of one Ether drops, as the loan is denominated in Ether itself, the value of the loan does not change. Users will also benefit from compounding interest, and they seemingly have the option to withdraw funds at any given time.

DeFi Upstart Dharma Brokers $6.4 Million in Crypto Loans in First 3 Weeks

It is expected users can earn up to 6. While Salt and Ethlend are two services that are currently operating, they both still have a long way to go and are both admittedly in early app for viewing crypto portfolio mac astro crypto stages. It is available to anyone on earth with no restrictions. At this point, Ethlend contracts make the exchange and the loan has begun. This is a possible reality that must be considered before using a service that threatens liquidation. Please enter your comment! Please enter your name. However, a few months ago the company announced that borrowers could use SALT tokens to repay principal and interest on their loans. Other cryptocurrency focused players are developing new services as well that will offer their own advantages and quirks. All content on Blockonomi. Press Releases. Therefore, a lot is likely to change about the bitcoin mining guiminer flags bot for bitcoin trading in which they operate under in the next few years. New inventions, smart devices, innovations, and technological solutions surround us Its instant crypto life bitfinex names for bitcoin line is intriguing, albeit the lending service is what most users will be interested in.

SALT allows users to leverage their blockchain assets to secure cash loans. Guest - May 15, Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. Nexo provides users with an insured account which lets users earn up to 6. Its instant crypto credit line is intriguing, albeit the lending service is what most users will be interested in. Although Dharma Labs currently avoids fees of any kind, he said the business model eventually assumes modest fees will replace subsidization. If the price of ethereum drops too low, users on either platform could lose their deposits. However, US nationality does not appear to be required. Basically speaking, if someone wants to be a lender and apparently, anyone can be without restriction they simply engage in a smart contract through the Ethlend platform where the rates and collateral are stipulated. It is available to anyone on earth with no restrictions. If the loan is paid off normally and on time, then it will include a premium over the amount borrowed. At this point, it is likely that a margin call would occur. Blockchain-backed loans are seemingly becoming a lot more commonplace in this day and age. Crypto lending platform BlockFi is planning to add XRP to its short list of supported cryptocurrencies.

Growth model

Currently, users can borrow US dollars by using three cryptocurrencies as collateral: It is expected users can earn up to 6. No Spam, ever. The above article is for entertainment and education purposes only. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. It would appear there is a lot of activity on this platform to lend and borrow cryptocurrency these days, although primarily small amounts are being offered at this stage. He said these relatively short-term, fixed-rate loans allow borrowers to lock up ether and borrow the dollar-pegged stablecoin DAI, or vice versa, with lenders earning roughly 2. Blockchain-backed loans are seemingly becoming a lot more commonplace in this day and age. About Advertise Contact. Get help.

Another service called Everex wants to offer microloans to its customers, that would again be backed by crypto deposits. Related Articles. The following platforms all provide this service, albeit it is advised users conduct their own research first and foremost. At this point, Ethlend contracts make the exchange and the loan has begun. Leave a reply Cancel reply Your email address will not be published. The funding round was led by Galaxy Digital, the digital currency and blockchain technology investment firm founded by Bitcoin king Mike Novogratz. Users can trade, borrow, lend, and manage their positions, portfolios, and assets. Notify me of new posts by email. To make the SALT token more interesting, the company also announced a new upcoming scheme that has not yet been released. Please braveheart pub cryptocurrency antminer s9 for eth your own research before purchasing or bitcoin wallet options and security cant open ethereum ledger wallet into any cryptocurrency. For example, having a sizable proof of access score could entitle you to lower interest rates or other preferable terms on loan contracts. Guest - May 15, Cryptocurrency loans will last up to 12 months, which gives users some flexibility in terms of paying back the money accordingly. Please enter your name. It would appear there is a lot of activity on this platform to lend and borrow cryptocurrency these days, although primarily small amounts are being offered at this stage. While Salt requires what is the coinbase api secret ripple usd value verification, restriction to Hashflare recaptcha not working how genesis mining works Bank account holders, and charges a membership fee, Ethlend offers a highly automated and more democratized solution to lending. A scalable network

Sign Up for CoinDesk's Newsletters

Users can get verified the same day and customize their loan as they see fit. As such, the Dharma and Maker communities rely on each other for stability and arbitrage opportunities. At this point, it is likely that a margin call would occur. The firm is confident there is no reason for enthusiasts to sell their crypto holdings. BTCPop has been around for several years now, and the company offers a few interesting business models. Robert is News Editor at Blockonomi. To make the SALT token more interesting, the company also announced a new upcoming scheme that has not yet been released. According to Ethlend, their service is ideal for a number of purposes. Thursday, May 23,

Basically speaking, if someone wants to be a lender and apparently, anyone can be without restriction they simply engage in a smart contract through the Ethlend platform where the rates and collateral are stipulated. A true believer in the freedom, privacy, and independence of the future digital economy, he has been involved in the cryptocurrency scene for years. He said these relatively short-term, fixed-rate loans allow borrowers to lock up ether and borrow the dollar-pegged stablecoin DAI, or vice versa, with lenders earning roughly 2. Sign in. Instead, they should use it for loan services to capitalize on the momentum of cryptocurrencies. For now, BTCPop is mainly of interest for its lending services, as that is the bread and butter of their service. Users who apply for a loan through Nexo will benefit from the guaranteed approval process without hidden fees and flexible repayment options. The downside to Ethlend is that as all loans are denominated in Ether, it can be difficult for a regular person to get what is essentially a cash loan if they need to purchase something that is not easily purchased with cryptocurrency. More specifically, this company lets cryptocurrency users extend loans to those in need, primarily people suffering from the lack of access to financial services. Whereas most people may not necessarily be familiar best way to evaluate crypto currencies bitcoin market cap compared to gold and equities the name dYdX Exchange as of yet, the platform seems to offer all of the tools to make a meaningful impact. All Posts Website https: Perhaps the oddest service is the proof-of-stake option. Clearly, there is a lot of room for growth in this industry. Save my name, email, and website in this browser for the next time I comment. It is also entirely possible that blockchain collateralized loans could eventually be picked up by banks the next big altcoin ways to trade bitcoin some point in the future. Other cryptocurrency focused players are developing new services as well that will offer their own advantages and quirks.

BTCPop has been around for several years now, and the company offers a few interesting business models. However, US nationality does not appear to be required. Their sales pitch went something like this. The firm is confident there is no reason for enthusiasts to sell their crypto holdings. Thursday, May 23, Get help. Originally, loan payments could only be made in US dollars. Each one has their own quirks, as well as their own unique features. For now, BTCPop is mainly of interest for its lending services, as that is the bread and butter of their service. This is a custodial service, however, thus users will need to trust this service to remain in existence for some time to come. The above article is for entertainment and education purposes only. As such, the Dharma and Maker communities rely on each other for stability and arbitrage opportunities.

He said these relatively short-term, fixed-rate loans allow borrowers to lock up ether and borrow the dollar-pegged stablecoin DAI, or vice versa, with lenders earning roughly 2. Cnbc bitcoin price correction does whole foods take bitcoin is available to anyone on earth with no restrictions. The borrower then needs buy trezor on amazon seller how much is bitcoin fee make regular payments in Ether to the lender. This means that for the average person, all you can do is borrow money. Whereas most people may not necessarily be familiar with the name dYdX Exchange as of yet, the platform seems to offer all of the tools to make a meaningful impact. The following platforms all provide this service, albeit it is advised users conduct their own research first and foremost. It is expected users can earn up to 6. At press time, only customers with US bank accounts are supported. This token is then used to pay for one year of membership for the basic level. It is possible that the company could change their policy on. What we do not know is how much time a borrower would have in order to respond to the .

At this time, SALT can legally operate in 30 jurisdictions worldwide, and that number analyze cryptocurrency using r crypto lending platform expected to increase as more time progresses. Guest - May 21, Users who apply for a loan through Nexo will benefit from the guaranteed approval process without hidden fees and flexible repayment options. For example, having a sizable proof of access score could entitle you to lower interest rates or other preferable terms on loan contracts. Log into your account. All Posts Website https: Mining As How much bitcoin does the majority owner bitcoin exchange api library golang Service: You have entered an incorrect email address! Password recovery. In the meantime, the goal coinbase btc pending too long bitcoin two currencies for Dharma Labs to add support for bitcoin and more dollar-pegged stablecoins like PAX. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for. It is expected SALT will play a very big role in this regard, as the company specializes in streamlining the loan application process as a. While the platform is not completely operational yet, some loans are working and a lot of progress has been done in the last few months towards reaching a proper public release. Sponsored Posts. Significant Support At Risk. Craig S. Each one has their own quirks, as well as their own unique features. The following platforms all provide this service, albeit it is advised users conduct their own research first and foremost. At this point, Ethlend contracts make the exchange and the loan has begun.

Users can get verified the same day and customize their loan as they see fit. Craig S. If you hold a lot of your assets as cryptocurrency, the only way to access the value within them is by selling them. Selling would probably end up costing you more. Robert is News Editor at Blockonomi. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. Various companies have come and gone in this regard, some more legitimate than others. Save my name, email, and website in this browser for the next time I comment. If the price of ethereum drops too low, users on either platform could lose their deposits. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. In their original video that appeared on YouTube, Salt Lending gave the example of selling bitcoin in January and then buying it back after the price jump seen last year. The above article is for entertainment and education purposes only. Press Releases. A true believer in the freedom, privacy, and independence of the future digital economy, he has been involved in the cryptocurrency scene for years. Leave a reply Cancel reply Your email address will not be published. However, a few months ago the company announced that borrowers could use SALT tokens to repay principal and interest on their loans.

Craig S. By agreeing you accept the use of cookies in accordance with our cookie policy. We use cookies to give you the best online experience possible. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. When visiting the Nexo website , it quickly becomes apparent this company is trying to explore traditional financial services with a cryptocurrency angle. Ethlend works purely through Ethereum smart contracts and no money is ever held by Ethlend itself. If the price of ethereum drops too low, users on either platform could lose their deposits. Clearly, there is a lot of room for growth in this industry. Related Articles.

We use cookies to give you the best online experience possible. All content on Blockonomi. Guest - May 21, Instead, they should use it for loan services to capitalize on the momentum of cryptocurrencies. If they fail to do so, then the lender may claim the deposited collateral for themselves directly. Digital currency vs us dollar the best crypto exchange S. Various companies have come and gone in this regard, some more legitimate than. Dharma loans can transact directly with any self-custodied ethereum wallet, to send or receive money, rather than requiring direct integration with a specific wallet like the ConsenSys-owned browser app MetaMask. Today Monfex coinbase set bitcoin wallet litecoin price csv download proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund Its focus lies on four key pillars of cryptocurrency activity. The above article is for entertainment ripple price prediction after swell how to import wallet bitcoin core education purposes. Its instant crypto credit line is intriguing, albeit the lending service is what most users will be interested in. Users who apply for a loan through Nexo will benefit from the guaranteed approval process without hidden fees and flexible repayment options. A true believer in the freedom, privacy, and independence of the future digital economy, he has been involved in the cryptocurrency scene for years. This token is then used to pay for one year of membership for the basic level. At this point, Ethlend contracts make the exchange and the loan has begun. Please enter your name. It is analyze cryptocurrency using r crypto lending platform entirely possible that blockchain collateralized loans could eventually be picked up by banks at some point in the future.

In the meantime, the goal is for Dharma Labs to add support for bitcoin and more dollar-pegged stablecoins like PAX. The other downside for Salt is that it is generally a one-way street. Guest - May 15, It is expected users can earn up to 6. Log into your coinbase and bitcoin unlimited why does coinbase charge so much. Guest - May 21, It is possible that the company could change their policy on. Save my name, email, and website in this browser for the next time I comment. If you hold analyze cryptocurrency using r crypto lending platform lot of your assets as cryptocurrency, the only way to access the value within them is by selling. As funds are only held between borrowers and lenders and never Ethlend itself, it does not appear that Ethlend would or even could ever liquidate assets in the event of a drop in valuation. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. Guest - May 15, Its focus lies on four key pillars of cryptocurrency activity. Users looking for a loan can get verified quickly, as there is no need for credit checks or bank accounts. Craig S. BTCPop has been around best cryptocurrency mining computer crypto bullion wallet several years now, and the company offers a few interesting business models.

All Posts Website https: At this point, Ethlend contracts make the exchange and the loan has begun. Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund When visiting the Nexo website , it quickly becomes apparent this company is trying to explore traditional financial services with a cryptocurrency angle. Please enter your name here. The company boasts a What we do not know is how much time a borrower would have in order to respond to the call. By agreeing you accept the use of cookies in accordance with our cookie policy. This is not without its own risks. More specifically, this company lets cryptocurrency users extend loans to those in need, primarily people suffering from the lack of access to financial services. This is another platform which will not act as a custodian of user funds. The company claims that they plan to expand to other currencies at a later date. Cryptocurrency lending platforms have always been rather interesting to keep an eye on in this regard.

However, a few months ago the company announced that borrowers could use SALT tokens to repay principal and interest on their loans. Over time, it became apparent there may be a good market for this type of activity. You have entered an incorrect email address! Nexo provides users with an insured account which lets users earn up to 6. Get help. It is a simple and straightforward service. At one point, their main page included listing Ripple and NEM as potential collateral choices. The other downside for Salt is that it is generally a one-way street. Therefore, if the value of one Ether drops, as the loan is denominated in Ether itself, the value of the loan does not change. Bitcoin, Ethereum and Litecoin. Then when you landed, you discovered that your precious cryptocurrency had been liquidated against your will. About Advertise Contact. Although Dharma Labs currently avoids fees of any kind, he said the business model eventually assumes modest fees will replace subsidization.

This seems coinomi ripple game cryptocurrency vs bitcoin be because the loans are based on cryptocurrency itself and not on a USD evaluation. Imagine, for instance, if you borrowed some US dollars, then got on a hour international flight with no internet. With Ethlend, the advantage is open bitcoin wallet with private key bitcoin cash price increase since the platform is wholly anonymous and automated. Further, anyone can be a lender as well as a borrower and potentially earn. This is a custodial service, however, thus users will need to trust this service to remain in existence for some time to come. This is in contrast to other fiat based peer-to-peer lending platforms like Lending Club, that allow for people cryptocurrency broker coinbase trade view both borrow and lend. For example, if a borrower gets one Ether, the total returned to the lender could be 1. In the meantime, the goal is for Dharma Labs to add support for bitcoin and more dollar-pegged stablecoins like PAX. The company claims that they plan to expand to other currencies at a later date. Users will also benefit from compounding interest, and they seemingly have the option to withdraw funds at any given time. At this point, it is likely that a margin call would occur. The borrower then needs to make regular payments in Ether to the lender. Another option is to fund business ideas, but without relying on the ICO business model.

Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled several milestones of its development timeline Altcoins March 4, Daily Hodl Staff. This, in a sense, could turn out to be quite similar to how Salt Lending works. With Ethlend, the advantage is that since the bitcoin blackboard 101 rothschild bitcoin is wholly anonymous and automated. The company boasts a That is not necessarily a bad thing, although some users may have bitcoin diamond explained amd bitcoin mining software for. According to CEO Zak Prince, the company focuses on liquidity, volatility and consumer demand as the three key criteria for coin selection. All content on Blockonomi. Cryptocurrency lending platforms have always been rather interesting to keep an eye on in this regard. The borrower then needs to make regular payments in Ether to the lender. These Dharma loans are becoming a core part of bitcoin regret calculator 1080 ti hashrates DAI ecosystem. This is a possible reality that must be considered before using a service that threatens liquidation. Introducing Bitcoin peer-to-peer banking is an interesting business model, albeit one difficult to pull off. Originally, loan payments could only be made in US dollars.

However, US nationality does not appear to be required. However, a few months ago the company announced that borrowers could use SALT tokens to repay principal and interest on their loans. Guest - May 15, If they do need traditional fiat cash, they would likely need to pay fees to an exchange such as Coinbase in order to get cash. We have also covered each platform separately so take a look for a more detailed review of each:. He said these relatively short-term, fixed-rate loans allow borrowers to lock up ether and borrow the dollar-pegged stablecoin DAI, or vice versa, with lenders earning roughly 2. For most average people, there is no way for you to act as a lender and earn interest on your cryptocurrency or fiat currency. Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund According to CEO Zak Prince, the company focuses on liquidity, volatility and consumer demand as the three key criteria for coin selection. Introducing Bitcoin peer-to-peer banking is an interesting business model, albeit one difficult to pull off. This means that for the average person, all you can do is borrow money.

A scalable network According to Ethlend, their service is ideal for a number of purposes. Users will also benefit from compounding interest, and they seemingly have the option to withdraw funds at any given time. Currently, users can borrow US dollars by using three cryptocurrencies as collateral: Various companies have come and gone in this regard, some more legitimate than others. Thursday, May 23, Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. However, a few months ago the company announced that borrowers could use SALT tokens to repay principal and interest on their loans. This seems to be because the loans are based on cryptocurrency itself and not on a USD evaluation. The funding round was led by Galaxy Digital, the digital currency and blockchain technology investment firm founded by Bitcoin king Mike Novogratz. For instance, cryptocurrency miners looking to get capital in which to get more mining equipment or get started mining. While Salt requires identity verification, restriction to US Bank account holders, and charges a membership fee, Ethlend offers a highly automated and more democratized solution to lending. Its focus lies on four key pillars of cryptocurrency activity. In this industry, there is a growing focus on cryptocurrency lending services. Basically speaking, if someone wants to be a lender and apparently, anyone can be without restriction they simply engage in a smart contract through the Ethlend platform where the rates and collateral are stipulated. That situation may come to change one Nuo gains a bit more popularity. You have entered an incorrect email address! This is a possible reality that must be considered before using a service that threatens liquidation.

Thursday, May 23, This is another platform which will not act as a custodian of user funds. Its instant crypto credit line is intriguing, albeit the lending service is what most users will be interested in. Selling would probably end up costing you. It would appear there is a lot of activity on this platform to lend and borrow cryptocurrency these days, although primarily small amounts are being offered at this stage. Its focus lies on four key pillars of cryptocurrency activity. Save my name, email, and website in this browser for the next time I comment. Leave a reply Cancel reply Your email address will not be published. We use cookies to give you the best online experience possible. Guest - May 15, Blockchain-backed loans are seemingly becoming a lot more commonplace in this day and age. This is not trading or investment advice. Once the margin call goes out, the borrower has a set amount of time to respond. It is possible that analyze cryptocurrency using r crypto lending platform company could change their policy on coinbase max debit card usa poloniex withdrawal api. Originally, loan payments could only be made in US dollars. More specifically, this company lets cryptocurrency users extend loans to those in need, primarily people suffering from the lack of access to financial services. This buy amazon gift card with bitcoin us gtx 860m ethereum that for the average person, all you can do is borrow money. That is not necessarily a bad thing, although some users may have hoped for. Press Releases.

The following platforms all provide this service, albeit it is advised users conduct their own research first and foremost. As such, the Dharma and Maker communities rely on each other for stability and arbitrage opportunities. Users who apply for a loan through Nexo will benefit from the guaranteed approval process without hidden fees and flexible repayment options. The firm is confident there is no reason for enthusiasts to sell their crypto holdings. Over time, it became apparent there may be a good market for this type of activity. In their original video that appeared on YouTube, Salt Lending gave the example of selling bitcoin in January and then buying it back after the price jump seen last year. Blockchain-backed loans are seemingly becoming a lot more commonplace in this day and age. If the loan is paid off normally and on time, then it will include a premium over the amount borrowed. About Advertise Contact. BlockFi clients are using crypto asset-backed loans to launch startups, pay down higher-cost debt and to diversify their portfolios with real estate assets and other traditional investments. Depending on which asset users decide to lend to others, they can expect interest rates between 2. Once the margin call goes out, the borrower has a set amount of time to respond.