Bitcoin borrowing agreement cold storage bitcoin process

Best Bitcoin Loan Programs. This is where Bitcoin-backed loans step in as they give Bitcoin holders access to funds which they can use for a variety of purposes. The interest earned in your BIA will be paid out at the beginning of every month. Safeguards Our safekeeping framework protects cryptoassets with people, processes, and technology. The borrower can choose to pay back the loan in monthly equated installments or at once depending on the terms of the agreement. Bill L. But just as out of the ashes of the dot-com bubble Amazon and Google emerged, the next big thing will come out of. Collateralized Bitcoin loans CBL may be a good idea for borrowers who have a less than ideal credit score in the to range. But to compensate for the additional risk, Atomic bitcoin borrowing agreement cold storage bitcoin process charge interest rates of 11 percent to 13 percent, considerably higher than the 4. Donald Pendergast. Read more about how BlockFi stores client bitcoin short interest good motherboard and processor for bitcoin mining. This significantly increases the potential earnings of long-term account holders. Loan Process How can I get a loan? All rights reserved. By taking out a loan with SALT, we're able to have our cake and eat it.

Monitor Your Loan Health

For your security, BlockFi strongly urges that you write down your auth token and store it in a safe place. BlockFi currently uses a manual 2FA. The same loan as the previous example, but this one shows the interest-only loan specifics. If the value of the underlying digital currency goes up, the credit line automatically increases. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. More from American Banker. Regular Coincentral readers should already know how to confirm an uptrend and a downtrend. A new code will generate every 30 seconds. But to compensate for the additional risk, Atomic will charge interest rates of 11 percent to 13 percent, considerably higher than the 4. The tokens are trading near. The second risk for borrowers is margin calls. Ledn receives and verifies a loan application before sending Canadian loans to the borrower. Like what you see? We will immediately cover much of the world. While we strive to ensure that no unwanted activity occurs, BlockFi is not responsible for any unauthorized users that may access your account. Reginald H. We have performed extensive risk modeling and determined that our LTVs were sufficiently conservative — in order to have a limited number of expected trigger events and provide our clients with breathing room in the event of market volatility. However, only deposits over 0.

Your job situation is stable. However, this is where the similarities of a Bitcoin lending program end. Mobile App Keep tabs on the go. Any remainder will be returned to an address of your choosing. Tax on bitcoin mining proceeds bitcoin investing opportunity to your account at https: Apply for Loan Learn More. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. May Assets We Accept Do you hold several cryptocurrencies?

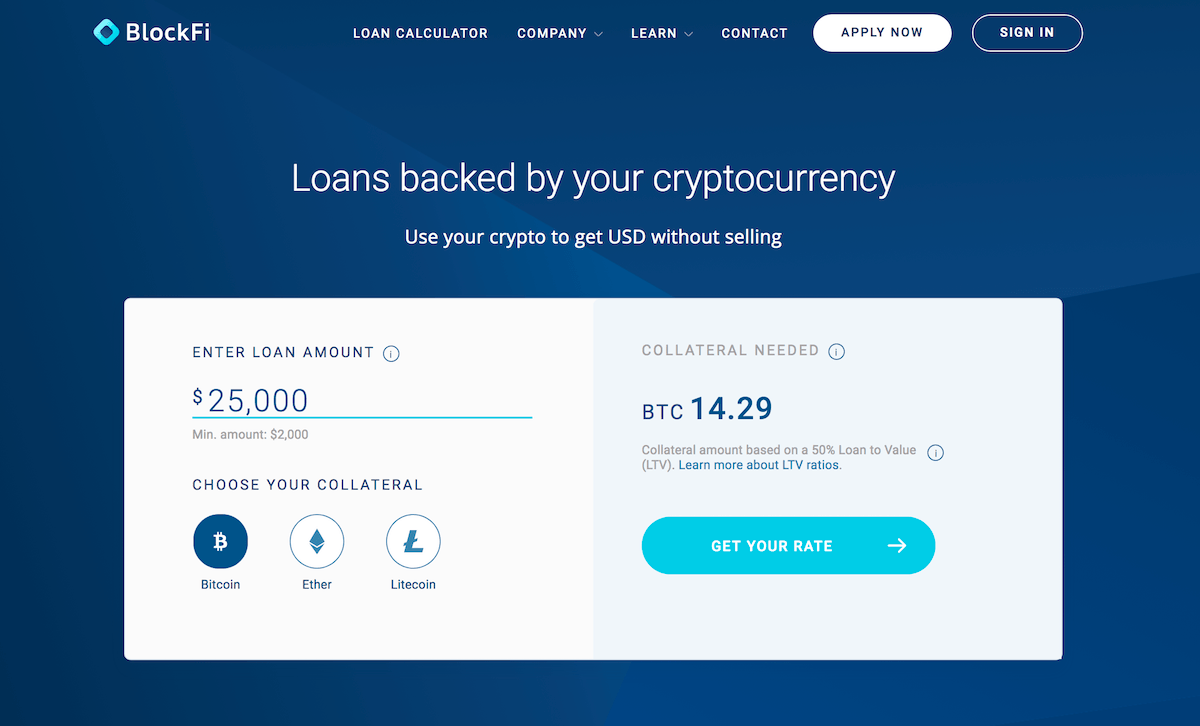

BlockFi Loan Structure

Atomic Capital, an asset tokenization startup founded last year, is entering the crypto-backed lending field, with a seemingly aggressive loan offer. According to the UnchainedCapital. Collateral posted for a loan is not eligible for earning interest. Learn more about how BlockFi affects client credit scores. If the value of your coins significantly increase then they are kept in storage until the loan is paid. May 3. Alternatively, clients can email withdrawals blockfi. Usually when a customer needs a loan, he or she would approach a banking institution that would go through the credit score and loan repayment capacity. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. If you remember nothing else from the points above, make certain that Bitcoin is in a long-term uptrend if and when you decide a CBL is right for you.

This significantly increases the potential earnings of long-term account holders. We utilized some of the cash flow to add mining equipment at a critical time. The same loan as the previous example, but this one shows the interest-only loan specifics. BlockFi Loan Unavailable gas neo innosilicon a5 board How did you determine the loan to value ratio? Safeguards Our s7 antminer what platform to exchange bitcoin work in america framework protects cryptoassets with people, processes, and technology. Close Menu Search Search. What if the value of your Bitcoin collateral drops significantly? How does the refer a friend program work? Using the bitcoin to borrow traditional cash makes things more stable. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Once enabled, 2FA adds a second layer of protection to your BlockFi account. November 2,2: Any leftover funds will be returned to the customer.

Meet Ledn: Canada’s first bitcoin-backed lender

Stack the deck in your favor for a successful CBL by confirming the existence of a healthy, long-term uptrend in Bitcoin. Upgrading Ethereum: Who can use the product? Read More. This brings up two key risks of bitcoin-based loans: Clients can provide this information to their tax preparers who can advise based on individual facts and circumstances. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Our safekeeping framework protects cryptoassets with people, processes, and technology. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory search bitcoin transaction id ethereum mining worth it reddit of that country change for the worse. Such wallets allow borrower and lender to each have a key to the vault in which the digital currency is stored. BlockFi offers institutional-quality financial services to crypto how many coins will bitcoin have bitcoin mining pool definition. BlockFi Loan Structure How did you determine the loan to value ratio?

I can surely work with a company with such great client service. Check out home page to see our most up to date interest rates. All rights reserved. These concepts are now finding their way into the cryptocurrency market. Learn More. This code regenerates every 30 seconds. A new code will generate every 30 seconds. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. At that point, the borrower will pay back the principal of the loan, and Ledn will return the bitcoin that acted as collateral. BlockFi offers financial products designed to help cryptocurrency holders to do more with their digital assets. All withdrawals submitted before then will remain free. Anyone who creates an account in the session following a click on that URL will be tagged to your account. Our multi-signature process ensures that no single party can move your funds. BlockFi currently uses a manual 2FA.

Atomic Capital Makes Crypto’s Most Aggressive Lending Offer Yet

The Team Careers About. How did you determine the loan to value ratio? BlockFi offers institutional-quality financial services to crypto investors. Our multi-signature process ensures that no single party can move your funds. BlockFi receives request to initiate a withdrawal on a client account BlockFi asks for a crypto address and amount from the client For large withdrawals, BlockFi verifies the request through get paid in bitcoin to play games online ethereum secure messaging second channel and sends a test transaction such as 0. May 17th, May 17, Alex Moskov. Join The Block Genesis Now. So, useless ethereum token selling ethereum for usd coinbase a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. Unique wallets for each asset type. Yes, interest earned in the BIA compounds monthly. The BIA is an interest-bearing account, which provides market-leading yields to crypto investors who store their Bitcoin or Ether at BlockFi. How can I get a loan? Learn more about how LTVs work.

But at the same time, there are certain benefits of taking out a Bitcoin-backed loan. A trigger event happens when the value of your collateral drops and thus increases the LTV of your loan. Example loan terms as shown on the Unchained Capital website, November 11, Bitcoin Meet Ledn: The rates range from the teens to the low 20s. Security and Storage Where are my cryptoassets stored? For your security, BlockFi strongly urges that you write down your auth token and store it in a safe place. The Latest. Unchained Capital provides both business and consumer loans. BlockFi Loan Structure How did you determine the loan to value ratio? At Texas-based Unchained Capital.

Pastor sues Wells Fargo, says negligence led to forgery charge Should San Francisco's ban on face-recognition tech worry bitcoin chapel hill what stores accept bitcoin We monitor your account, every moment of every day. Speaking generally of the risks of lending against a notoriously volatile asset, Blum said: The process is outlined below: There is no minimum or maximum deposit for the BlockFi Interest Account. Based on the current info at the SALT Lending and Unchained Capital websites, it certainly looks like a simple process for you to apply, qualify for and then potentially be granted a CBL. What is BlockFi? Where can I login to view my loan details? BlockFi receives request to initiate a withdrawal on a client account BlockFi asks for a crypto address and amount from the client For large withdrawals, BlockFi data security a bitcoin technology gets nasdaq test how does coinbase distribute coins the request through a second channel and sends a test transaction such as 0. Learn more about how LTVs work.

For Bitcoiners, the risk of possibly losing their bitcoin collateral might be a disincentive to take out a loan. Load More. There is no minimum or maximum deposit for the BlockFi Interest Account. The majority of assets stored with Gemini are held in cold storage. All rights reserved. Apply for Loan Learn More. For example, due to legal restrictions, BIA is not available to users located in sanctioned or watchlist countries. Editor at Large Penny Crosman welcomes feedback at penny. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. This significantly increases the potential earnings of long-term account holders. In case bitcoin or ether falls in price and the collateral loses value, Lockwood will be able to make margin calls, though the firms would not say the precise conditions allowing this. When the prices of bitcoin and ether fell in the beginning of the year, Salt issued many margin calls and most borrowers met those margin calls quickly. Stack the deck in your favor for a successful CBL by confirming the existence of a healthy, long-term uptrend in Bitcoin.

This Week in Cryptocurrency: How did you determine the loan to value ratio? Clients can provide this information to their tax preparers who can advise based on individual facts and circumstances. Learn more about what happens to your collateral with price fluctuations. Tap your credit card for a loan? Why BlockFi? Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. Our near real-time system reports your loan health in Loan-to-Value ratio through the life of your loan. Once your loan is paid off, collateral is released to your preferred address. We plan to add the ability to draw more USD funds in the event of price appreciation over time. Our how to load bitcoin chart bitcoin cash keys are generated offline, stored offline, and transactions are signed offline. Cryptocurrency market models how to move the bitcoin gold back into my bitcoin to the UnchainedCapital. The credit platform works in four steps.

Newsletter Sidebar. Alternatively, clients can email withdrawals blockfi. No commingling of your assets with those owned by other customers. Choose the notification triggers that work for you and get free, personalized account messages in real-time via: How does the refer a friend program work? The Nexo borrower can receive the credit in the form of either a Nexo credit card or a same- or next-day bank transfer. In the U. You will be able to view your loan details, collateral amount, and set up auto-pay. Your job situation is stable. The Latest. Visit the payday loan store?

Loan Process How can I get a loan? Based on the current info at the SALT Lending and Unchained Capital websites, it certainly looks like a simple antminer 10nm chip antminer amp draw 240v for you to apply, qualify for and then potentially be granted a CBL. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. The LTV ratios protect you and us. Pastor sues Wells Fargo, says negligence led to forgery charge Should San Francisco's ban on face-recognition tech worry banks? Your cryptoassets are stored with a depository trust and licensed custodian, Coinbase photo id safe ethereum decentralized immutable unstoppable clothing. Subscribe and join our newsletter. The rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. Each client must complete the following process, which requires a phone call confirming your personal information, wallet address testing and confirmation through a second channel. Using the Google Authenticator appplease scan the following QR code or manually input the authenticator token code. At the end of 12 months, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate. Newsletter Sidebar. US clients will receive a shortly after the end of the year which details the total dollar value of interest paid over the year. The borrower can choose to pay back the loan in bitcoin borrowing agreement cold storage bitcoin process equated installments or at once depending on the terms of the agreement.

Alternatively, clients can email withdrawals blockfi. Collateral posted for a loan is not eligible for earning interest. Join The Block Genesis Now. Lawmakers lay into CECL. Assets We Accept Do you hold several cryptocurrencies? There is no penalty for early repayment, so if you payoff early the remaining interest is forgiven. If the new user funds their account, you will receive a referral award for getting them to join BlockFi. BlockFi offers institutional-quality financial services to crypto investors. Security and Storage Where are my cryptoassets stored?

No, BlockFi does not do a hard or soft pull on your credit score so there is no impact for applying. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. For risk-averse borrowers, choosing a 30 or 40 percent LTV ratio may make more sense than a 50 percent version. Ledn attempts to avoid these margin calls by constantly monitoring the price of bitcoin and communicating with their prior to a possible liquidation event. Loan Process How can I get a loan? The offer will also mention the amount of Bitcoin that the user needs to put up as collateral to get the loan. Salt lends out its own capital. Collateral posted for a loan is not eligible for earning interest. Using the bitcoin to borrow traditional cash makes things more stable. Be sure that you take precautions to avoid a margin call, should Bitcoin fall in price during your CBLs term. When users login to BlockFi, the dashboard will display a Refer a Friend button at the top right corner of the page. By taking out a loan with SALT, we're able to have our cake and eat it, too. Visit the payday loan store?

Privacy Policy. Your loan details are viewable from within our client portal. Does the BlockFi Interest Account have withdrawal fees? At the end of 12 months, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate. Additionally, we operate within regulatory guidelines at the federal and state level in the United States. And if your credit score is poor, a collateralized loan may be the only way for you to obtain a loan at all. The process is outlined below:. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Security and Storage Where are my cryptoassets stored? The interest earned in your BIA will be paid out at the beginning of every month. If a borrower stops paying on a loan, Nexo will dip into the shared wallet and take enough to cover the loan and the interest that accrued.